Pressure on OPEC+

Whether its market prices or threats from oil-consuming countries, OPEC+ is warmly invited to increase production by more than the 0.4 mb/d monthly hike planned for December.…

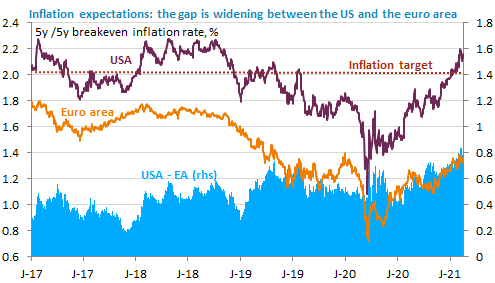

US retail sales posted a strong rebound in January while industrial activity remained solid. This can only reinforce doubts about the relevance of a recovery plan as massive as the one the White House wants to put to the vote. This can only fuel inflation expectations as well. The spread between inflation expectations in the US and in the euro area is reaching record-high levels (see the Graph of the Day), which contributes to support the USD against the euro even if the Fed minutes showed there is no change of policy in sight. The EUR/USD plunged yesterday and is now trading below 1.2050.

Get more analysis and data with our Premium subscription

Ask for a free trial here