There is renewed concern

The US equity markets fell again yesterday, this time more sharply (-2% for the S&P 500 and -3% for the Nasdaq). The sharp decline in the…

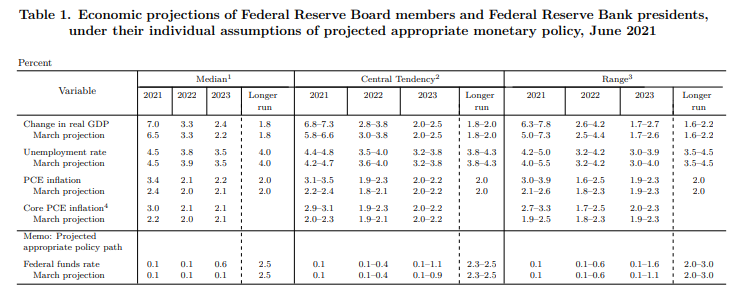

The Fed did almost exactly what was expected, but the small surprise made a big difference. Once again, this surprise came from the “Dots”, i.e. the individual Fed members’ rate forecasts. A shift from 2024 to 2023 for the 1st rate hike was expected. But not two rate hikes as soon as 2023. Bond yields jumped higher (although they have returned to their level of the beginning of last week), equities had a bad day in the US and overnight in Asia and the USD rebounded, the EUR/USD pair falling straight from 1.21 to below 1.20. The debate on the transitory nature of inflation will not close quickly.

Get more analysis and data with our Premium subscription

Ask for a free trial here