Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

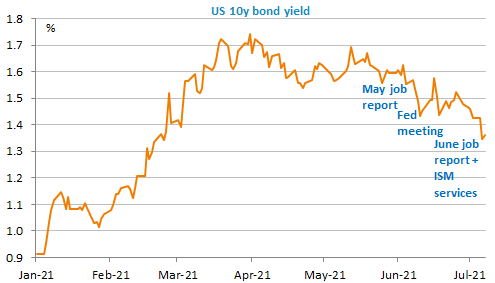

A lower-than-expected ISM in services in June (down from 64 to 60.1) in the US triggered a sharp fall in bond yields. Despite recent tensions on oil prices, the markets really seem to gradually abandon the reflation trade. As shown by the Graph of the day, the US 10y has declined from 1.6% to 1.35% since early June. US economic reports remain good, but do not surprise on the upside anymore. Supply issues are expected to limit the growth potential and the Fed is seen keeping inflation under control. The publication of the Fed Minutes today will allow us to gauge the balance of power between the hawks and the doves.

Despite lower bond yields, the USD is strong against the euro, around 1.182, which also points to markets more cautious regarding growth prospects. US equities were slightly down yesterday (except the Nasdaq), but they have been up over the last few weeks.

Get more analysis and data with our Premium subscription

Ask for a free trial here