Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

The surging wind output over central western Europe combined with above-average temperatures and rather inflexible nuclear generation strongly pressured the power spot prices yesterday. The Belgian day-ahead contract presented the deepest fall (down to 0.25€/MWh on average, -48.02€/MWh day-on-day) with prices dropping as low as -51.50€/MWh for the 12am-1pm hour. In Germany, France and the Netherlands, the power prices eroded 17.36€/MWh to average 34.02€/MWh.

The milder temperatures weakened the French power consumption by 0.46GW to 63.90GW on average on Wednesday. The country’s nuclear generation edged up to 43.56GW (+0.13GW dod). The German wind production started soaring and gained 10.31GW to average 14.28GW. The production is forecasts to climb above 43GW on average today and reached near 48GW late this afternoon, before slightly easing but remaining above 41GW over the next couple of days.

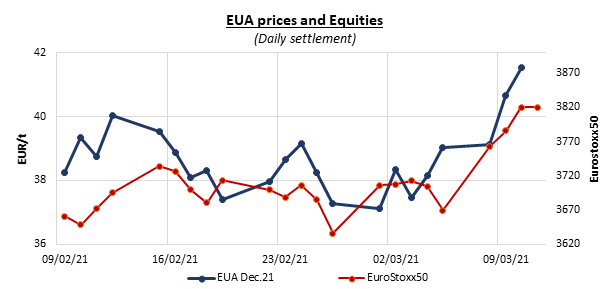

The carbon prices continued to extend their bullish trend on Wednesday, hitting a fresh record of 41.85€/t in the morning before immediately retreating but progressively rising throughout the remaining of the day. Most market participants are attributing this new surge (initiated on March 4th) to the speculators with support from the soaring equities and looming US stimulus plan, and some are hence expecting a correction once these financial players decide to take their profits, although the late-compliance buyers are limiting the downside potential of emissions prices and others are more doubtful, pointing at the strong buying interest each time prices started to slid back over the past weeks. The speculators continue to push carbon prices further up in uncharted territories, with no real technical resistances other than the “psychological” round numbers, perhaps aiming at the next call options with the largest open-interests (currently the ones with strikes prices at 45€/t and 50€/t).

Meanwhile, the Commitment of Traders report for last week showed little change in the total net position of the market participants, with for instance the Investment funds only increasing it by 0.84mt (+0.16%) from the week prior. Beside the “Investment Firms or credit institutions” raising their short likely for carry trade reasons, only the Commercial Undertaking presented a noticeable change by increasing their “risk reducing directly related to commercial activities” (basically hedging) long position by 15.6mt (+18.4%).

The soaring gas and emissions prices pushed the power curve prices significantly up yesterday.

Get more analysis and data with our Premium subscription

Ask for a free trial here