Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

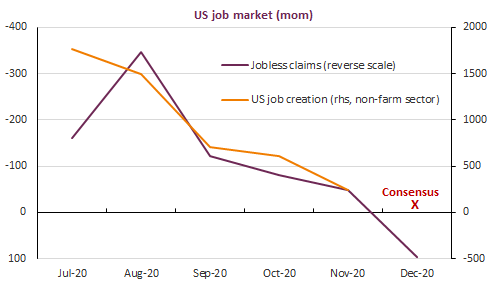

Donald Trump conceded his defeat for the first time, as he tries avoiding to be expelled from the White House before January 20th. But the market does not care, focused on prospects of more economic stimulus with a US Congress controlled by the Democratic party. Equities posted strong gains yesterday and the US 10y is now nearing 1.1%. The USD is more resilient than expected in this context, the EUR/USD trading below 1.23, as some Fed members have started to express more hawkish views. Japan has declared a state of emergency for some areas including Tokyo. The pandemic keeps on spreading fast everywhere. The impact of the vaccination campaign will only be felt later this year. US job report today.

Get more analysis and data with our Premium subscription

Ask for a free trial here

We will get back in touch with you soon.

Don’t forget to follow us on twitter!