Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

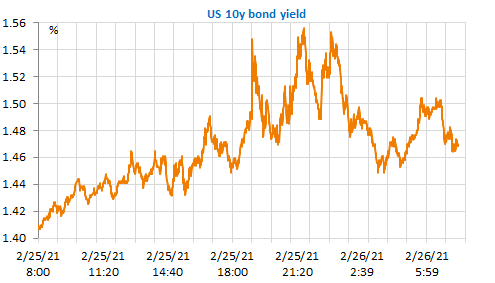

Losses on bond markets worsened sharply yesterday, especially in the US, where the 10y bond yield briefly jumped above 1.6%. The US stock market registered a big downward correction, tech stocks giving up more than 3.5%. The rise in interest rates constitutes a very serious threat for all risky assets whose valuation has sometimes reached levels considered to be very excessive. Central banks may be forced to intervene again to cap this rise, but that could also exacerbate the problem. The market seems calming down this morning, but that may only be a respite. The EUR/USD that reached 1.2243 has fallen back to 1.2140 on stronger risk aversion.

Get more analysis and data with our Premium subscription

Ask for a free trial here