Markets absorb Fed announcements smoothly

For a detailed analysis of the Fed’s announcements after its meeting, you can refer to the News sent last night. Unsurprisingly, the process of reducing asset purchases should…

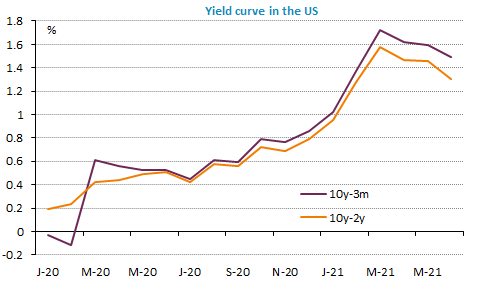

Long-term bond yields have erased most their post Fed-meeting rise yesterday but the rise persists on shorter-term maturities. This reflects expectations that the Fed should tighten its policy sooner than expected and therefore be able to keep inflation under control. The equity market resisted well in this context. US tech stocks even rebounded. The USD kept its gains too and even reinforced them: the EUR/USD exchange rate plunged to 1.19.

Get more analysis and data with our Premium subscription

Ask for a free trial here