The yield curve flattens in the US. Sharp rise in the USD

Long-term bond yields have erased most their post Fed-meeting rise yesterday but the rise persists on shorter-term maturities. This reflects expectations that the Fed should…

Financial markets should remain rather cautious today ahead of the end of the Fed meeting. We do not expect any policy change, but the tone of the statement and comments from Jerome Powell will be closely monitored. Inflation expectations continue to rise, pushing US bond yields and the USD higher. The European Union lives in another world made of vaccine shortages and endless containment. The EUR/USD pair is trading around 1.19.

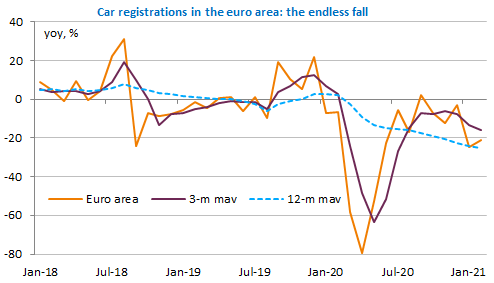

Car registrations in Europe were down by around 20% yoy in February to record-low levels for this period of the year.

Get more analysis and data with our Premium subscription

Ask for a free trial here