Strongly up for most of the session, prices weakened at the close

European gas prices were mixed yesterday, rising sharply for most of the session before falling back at the close. Strong Asia JKM prices (+13.24%, to…

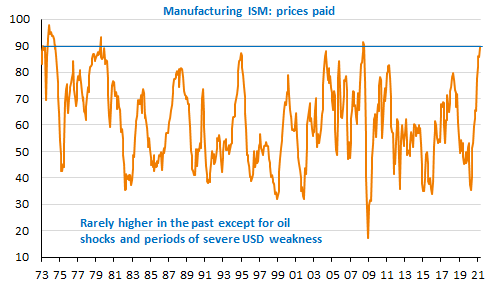

Purchasing managers’ indices continue to be close or at historical highs in the manufacturing industry, pointing to strong growth in this sector. The small decline in the US ISM only shows that activity has ceased to accelerate in April. Bond yields are marginally down and the USD is rather stable: the EUR/USD exchange rate is trading in a narrow range around 1.2030.

Get more analysis and data with our Premium subscription

Ask for a free trial here