Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

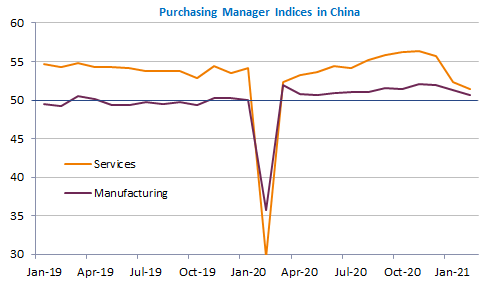

Bond yields have declined significantly on Friday, erasing almost completely Thursday’s rise. This does not mean tensions are over: in the US, the House of Representatives voted the $1.9bn stimulus package that will now be debated at the Senate. A sharp rise in inflation is also coming that will probably fuel further tensions on the bond market. For the time being, the question is whether the correction in the bond market has been too quick and may trigger central banks’ intervention, just as it happened in Australia on Friday. Moreover, the Chinese PMIs kept on deteriorating in February, pointing to an economic slowdown that may be more significant than expected. The EUR/USD is edging up and nearing 1.21 after a marked downward correction since Thursday.

Get more analysis and data with our Premium subscription

Ask for a free trial here