OPEC will incrementally add 1.1 mb/d of production up to July

OPEC members in their latest meeting decided to ramp up progressively output up to July, where they expect output to rise by at least 1.1…

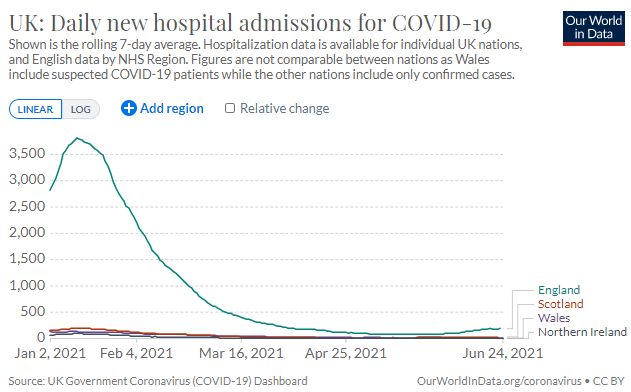

US equities had their best week since February last week. The dovish speeches of some Fed members and the deal about the infrastructure plan in the US fueled optimism. Yet, the Fed’s preferred measure of inflation reached its highest level since 1992 in May and the delta variant keeps on spreading in the UK. The USD rebounded after having weakened significantly on Friday: the EUR/USD exchange rate is trading around 1.1930 after a peak at 1.1975 on Friday.

Get more analysis and data with our Premium subscription

Ask for a free trial here