EUAs cautiously inched up on positive conflict developments

The easing power demand, rising wind production and decreasing gas prices continued to pressure the power spot prices yesterday which averaged 240.80€/MWh in Germany, France,…

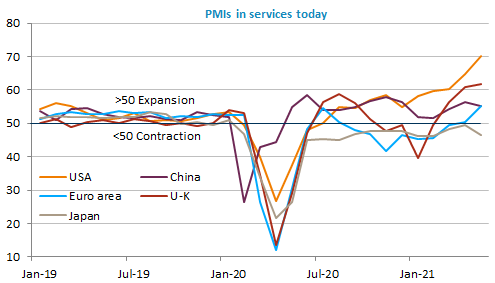

The market seems on hold, but remains confident overall: limited gains in equities and bond yields slightly down. The USD is rather stable too: the EUR/USD exchange rate was a bit weaker yesterday, but is trading near 1.22 again this morning. The Fed’s Beige Book was not particularly reassuring about inflationary tensions, but did not bring anything really new either. Fed speakers are gradually imposing the idea that a reduction in bond purchases is coming and they manage to do so without damage. PMIs in services today as well as the ADP figures ahead of the job report tomorrow, the next big market mover.

Get more analysis and data with our Premium subscription

Ask for a free trial here