Keystone XL is cancelled, a boon for US producers

Brent futures weakened on Wednesday, to reach 55.8 $/b for the prompt contract after surprise builds across all US inventories, reported by the API survey.…

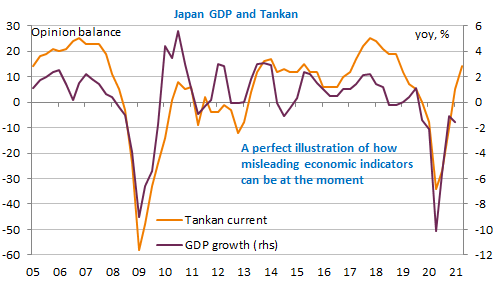

The Bank of Japan’s Tankan points to activity rebound, but it should remain dependent on global recovery and what comes first is a new recession. Asian equity markets were down overnight on worries linked to the spread of the Delta variant. European markets followed the same trend yesterday, but US stocks were more resilient, with only tech shares posting losses. Bond yields have continued adjusting downwards ahead of the key ISM and job reports today and tomorrow. The USD keeps on strengthening, the EUR/USD exchange rate now trading below 1.1850, its lowest level since early April.

Get more analysis and data with our Premium subscription

Ask for a free trial here