The Iran factor seems to outweigh the Russian risk

Oil prices are almost stable, subject to two opposing forces. The price of Brent 1st-nearby seems to be trending very slightly downwards and is trading around…

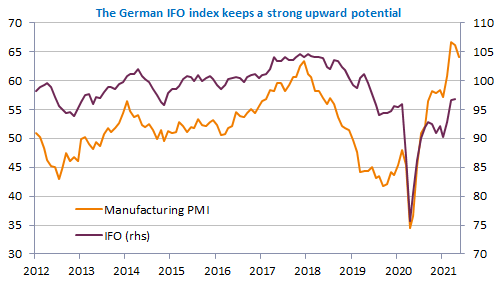

Inflation expectations continue to decline and the US 10y bond yields is back below 1.6%. Reassuring comments from Fed members yesterday about the transitory nature of inflationary tensions reinforced the trend and fueled risk appetite. US consumers may express more concerns through the Conference Board survey that will be released today, while the IFO survey should confirm optimism about the recovery reigns in Germany today. The EUR/USD exchange rate is on the rise, well above 1.22 now.

Get more analysis and data with our Premium subscription

Ask for a free trial here