Strong gas pushes EU power curves higher, spot plunges on mild and windy weather

Spot power prices were sharply down in NW Europe on Tuesday on expectations of a jump in German wind power generation from 6.5 GW on…

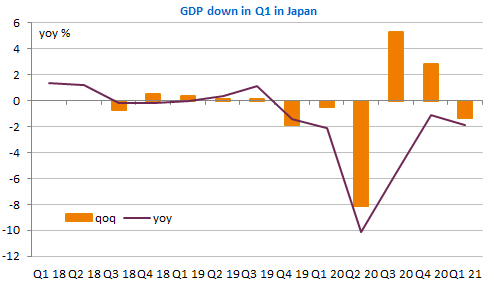

The inflationary threat continues to take center stage, particularly in the US and probably for some time to come. Bond yields edged up and equities lost some ground yesterday, although European markets are up this morning. The USD weakened further, the EUR/USD pair now nearing 1.22, but overall the market moves should remain rather moderate ahead of the release of the Fed minutes tomorrow. The Japanese Q1 GDP figures were a bit worse than expected, as activity posted a 1.3% qoq contraction in Q1.

Get more analysis and data with our Premium subscription

Ask for a free trial here