EUAs retreated after an early jump

The European power spot prices continued to fade yesterday amid forecasts of milder and windier weather. Prices hence eroded 5.05€/MWh to 38.89€/MWh in France, Germany,…

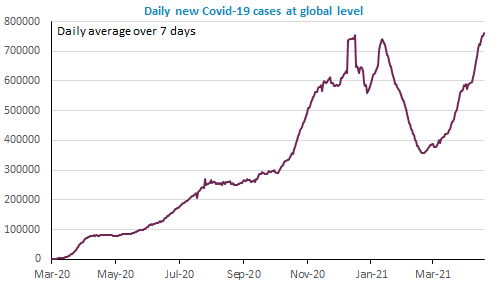

When the economic agenda is empty, markets look elsewhere and these day they see most of countries remaining in the grip of the pandemic and also political tensions on the rise. The US stock market registered its biggest downward correction in a month yesterday, while bond yields edged up. The recent behavior of the bond market has been actually very strange. The USD resumed its fall and the EUR/USD exchange rate broke 1.20.

Get more analysis and data with our Premium subscription

Ask for a free trial here