Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

Baring the sharp drop in Chinese equities due to the crackdown against education companies, equities have remained almost stable yesterday. Slight moves on the bond market and a very limited weakening in the USD too. To answer the question, it is not summer break yet, as there are many key economic indicators on the agenda this week and a two-day Fed meeting is starting today, but it feels like it already.

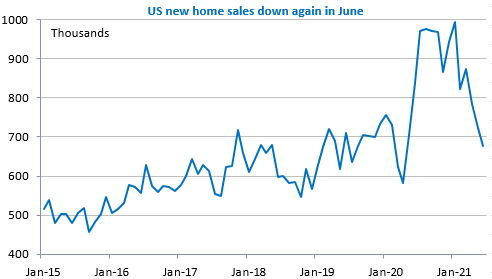

The German IFO survey showed business climate down for the 1st time since January, a deterioration fueled by both supply issues in the manufacturing sector and the resurgence of Covid cases in services. In the US, new home sales fell sharply and unexpectedly for the 3rd month in a row in June, below their pre-crisis level. Here again, supply issues have sent construction costs and home prices sharply higher, which has discouraged potential home buyers. Chinese industrial profits slowed down further in June to +20% yoy due to the gradual easing in the basis effect.

Get more analysis and data with our Premium subscription

Ask for a free trial here

On the agenda today, some key US economic indicators: durable goods orders, home prices and the Conference Board consumer confidence survey, but markets should remain cautious ahead of the Fed.