A break before choosing

While the fighting in Ukraine is intensifying, financial markets seem to be calming down somewhat. Equity markets trimmed their losses in Europe yesterday, fell little…

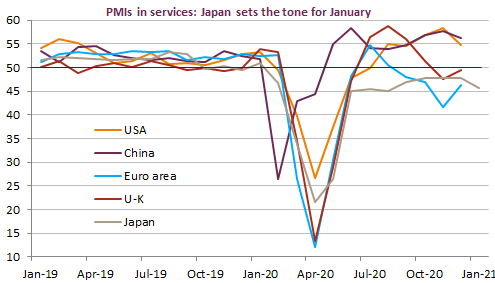

Equity markets were down on Friday after the release of indicators pointing to recession in Europe, concerns heightened by the announced delays in vaccine deliver. But the weakening in the USD shows that markets remain fundamentally optimistic about recovery prospects, as the White House is deploying efforts to get a quick vote of the $1.9tn stimulus plan. The Fed meeting, later this week, is also expected to bring confirmation that any reduction in the amount of bond purchases is not topical. Risk appetite was back with a vengeance overnight in Asia. The EUR/USD is nearing 1.22.

Get more analysis and data with our Premium subscription

Ask for a free trial here