Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

The Fed statement was slightly more hawkish, as “progress” has been made towards the targets of maximum employment and price stability. In the press conference that followed the meeting, Jerome Powell acknowledged they had a deep discussion about bond tapering but said they were not there and that there was “ground to cover” to get there. He also said they were clearly “a ways away” from considering rate hikes. He was both reassuring on inflation (still seen as temporary high) and the economic impact of the surge in Covid cases linked to the Delta variant.

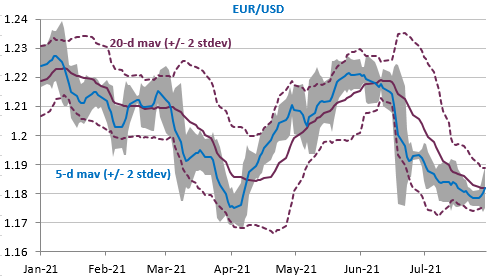

The market was left uncertain: the initial reaction to the slightly more hawkish statement was quickly erased and eventually, bond yields were marginally down, equities rebounded from their lows and the USD weakened. The EUR/USD exchange rate is now trading above 1.1850 and the move may continue as the 5-day moving average is about to top the 20-day moving average for the first time since early June.

Get more analysis and data with our Premium subscription

Ask for a free trial here

About the Fed, the next key events for the markets will be the release of this meeting’ minutes (Aug. 18), the Jackson Hole symposium (Aug. 26-28) and the next FOMC meeting, with updated forecasts (Sept. 21-22).

On the agenda today, a likely strong rebound in German inflation in July due to a big basis effect (the cut in the VAT rate in July 2020), the EU Commission survey, the first estimate of Q2 GDP growth and weekly jobless claims in the US. No time to get bored!