Prices maintain their downtrend

Prices were down again yesterday in most European gas markets, pressured by the increase in pipeline supply. Indeed, Norwegian flows rebounded, averaging 305 mm cm/day,…

Get more analysis and data with our Premium subscription

Ask for a free trial here

After US equities recorded their first decline in 4 weeks last week, Asian markets fell on growing concerns over the quick spread of the Covid delta variant. US 10-year bond yields continue to fall, now below 1.3% and the USD is strengthening, with the EUR/USD below 1.18.

The UK example shows that despite a still rather low rate of hospitalization and few deaths, while the number of new cases has come back near its previous peaks, the impact on the economy could still be significant due to voluntary distancing. While the UK puts an end to pandemic restrictions today, the Prime Minister and the Finance Minister have been forced to self-isolate, as they had meeting with the Health Secretary who tested positive for Covid-19.

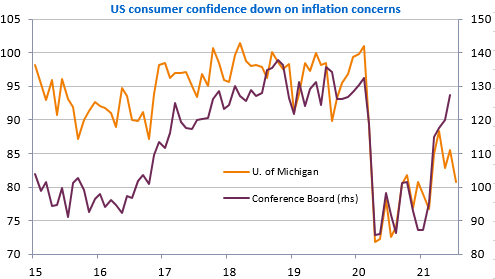

The spread of the delta variant should also reinforce global supply issues and inflation fears, as many emerging countries with low vaccination rates are forced to impose strict lockdown measures again. In the US, retail sales were stronger than expected in June (+0.6% mom), but the consumer confidence index of the University of Michigan plunged, in the wake of purchasing intentions, which were hit by rising prices.