Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

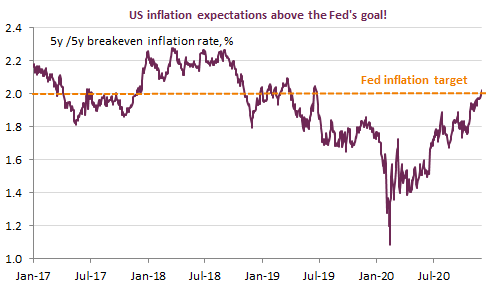

At the time of writing, it seems Democrats have won one of the two remaining seats for the Senate, but the outcome of the second vote is still really uncertain. Prospects of a Senate controlled by Democrats have sent inflation expectations and bond yields on the rise, with the US 10y topping 1% for the 1st time since March. The USD is lower on prospects of higher US deficits and also stronger growth (boosting risk appetite). The EUR/USD pair is now trading above 1.23. Equities are mixed, as Mr. Biden’s economic program does not only mean stronger budgetary stimulus but also higher taxes, more regulation for the tech giants and a push towards energy transition.

Get more analysis and data with our Premium subscription

Ask for a free trial here