Wait and see

No big moves on financial market. January US inflation figures came out a bit below expectations, which reinforced the wait-and-see attitude and perplexity in a…

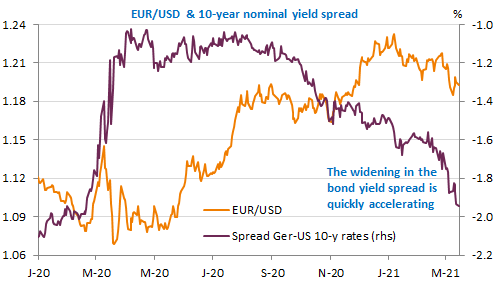

The US Treasury bond yield is now trading above 1.6%, while the ECB has managed to stop the increase in the euro area. In this context, the EUR/USD pair remains under downward pressure but not as much as we could have thought: it is trading around 1.1930 this morning. Chinese economic reports showed activity sharply up yoy due to a huge basis effect. A closer look at the figures shows that industrial activity is robust, consumer spending and investment much less.

Get more analysis and data with our Premium subscription

Ask for a free trial here