Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

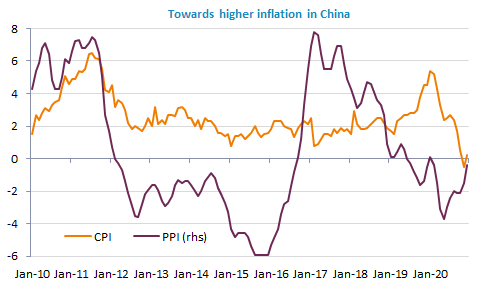

After their best week since November, equity markets should start this one with much more caution, as it was already the case in Asia. The rise in US bond yields carries both expectations of stronger real growth boosted by substantial budgetary stimulus in the first days of the Biden presidency and signs that inflation is picking up, with especially oil prices strongly on the rise since April 2020. US democrats have also warned vice-president Mike Pence they would go ahead this week with a new impeachment procedure against Mr. Trump if he does not invoke the 25th

amendment to revoke him. The USD has been rebounding significantly and the EUR/USD broke key technical supports to trade below 1.22.

Get more analysis and data with our Premium subscription

Ask for a free trial here