OPEC+ maintains its output policy

Without material surprises, OPEC+ countries maintained their production policy unchanged yesterday, with 0.4 mb/d monthly production increases considered to be sufficient to respond to a…

Get more analysis and data with our Premium subscription

Ask for a free trial here

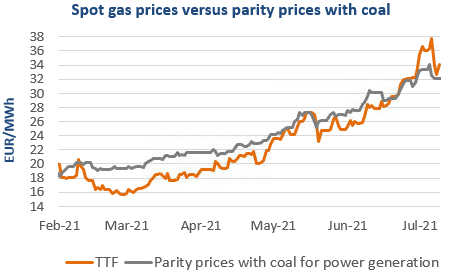

Prices rebounded in most European gas markets yesterday, supported by tight pipeline supply and technical rebound. Russian supply was almost stable, averaging 247 mm cm/day, compared to 248 mm cm/day on Wednesday, with flows to Mallnow (landing point of the Yamal pipeline) still at 0 because of maintenance. Due to an unplanned outage at the Oseberg field, Norwegian flows dropped to 328 mm cm/day on average, compared to 332 mm cm/day on Wednesday. Note that parity prices with coal for power generation were almost stable as the slight increase in coal prices was offset by the slight drop in EUA prices.

At the close, NBP ICE August 2021 prices increased by 2.920 p/th day-on-day (+3.69%), to 82.150 p/th. TTF ICE August 2021 prices were up by 97 euro cents (+3.01%) at the close, to €33.312/MWh. On the far curve, TTF Cal 2022 prices were up by 51 euro cents (+2.08%), closing at €25.122/MWh.

As supply is still tight, spot and near curve gas prices could remain today above parity prices with coal for power generation (currently at €32.106/MWh on the month-ahead) to trigger an additional drop in gas demand for power generation.