EUAs inched up amid continuous illiquidity

The weakening French nuclear production, ongoing wind shortage and high gas prices maintained the European power spot prices above 200€/MWh for today. The day-ahead prices…

Get more analysis and data with our Premium subscription

Ask for a free trial here

European gas prices were mixed on Friday, torn between (slightly) more comfortable spot fundamentals and ongoing strong Asia JKM and parity prices with coal for power generation. On the pipeline supply side, Russian flows rebounded to 271 mm cm/day on average on Friday (compared to 162 mm cm/day on Thursday) as the Nord Stream 1 gas pipeline restarted after its 10-day planned maintenance. By contrast, Norwegian flows were down, averaging 309 mm cm/day, compared to 312 mm cm/day on Thursday.

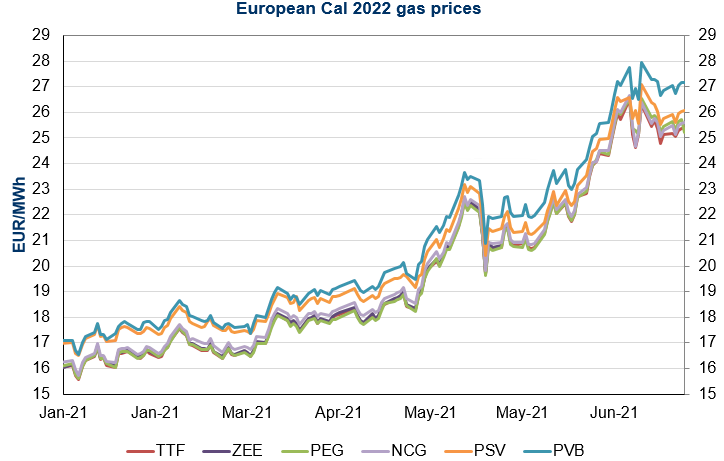

At the close, NBP ICE August 2021 prices dropped by 1.240 p/th day-on-day (-1.38%), to 88.440 p/th. TTF ICE August 2021 prices were down by 61 euro cents (-1.68%) at the close, to €35.523/MWh. On the far curve, TTF Cal 2022 prices were up by 4 euro cents (+0.17%), closing at €25.396/MWh.

The restart of Nord Stream 1 could exert a downward pressure on European gas prices today. However, low stock levels and strong Asia JKM prices remain supportive and could contribute to limit losses. Moreover, technical supports (€35.105/MWh on TTF August 2021 and €25.250/MWh on TTF Cal 2022) could also trigger some buying.