US to tap into strategic reserves

In less than 2 hours yesterday, the price of Brent 1st-nearby first approached $115/b before plunging towards $104/b. It has since recovered to around $113/b. Fears of…

Get more analysis and data with our Premium subscription

Ask for a free trial here

European gas prices rebounded on Friday, supported by the strong rise in JKM prices in Asia (where high temperatures are driving demand up) and technical buying. On the pipeline supply side, Russian flows were stable at 163 mm cm/day on average yesterday, with the Nord Stream 1 gas pipeline still shut for a 10-day planned maintenance that started on 13 July. Norwegian flows were almost stable, averaging 326 mm cm/day, compared to 327 mm cm/day on Thursday.

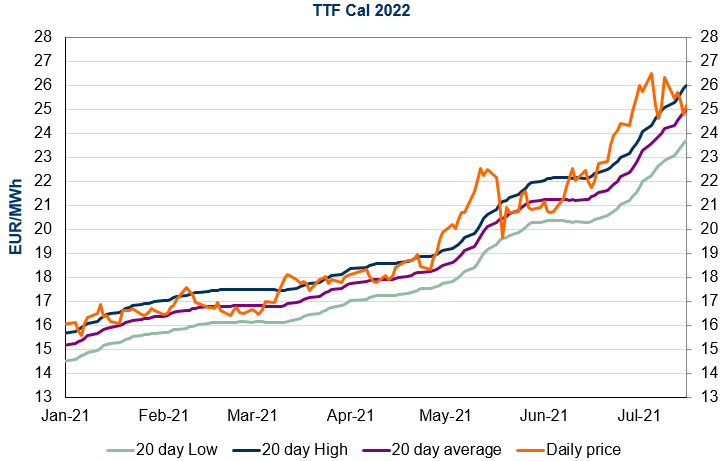

At the close, NBP ICE August 2021 prices increased by 2.350 p/th day-on-day (+2.83%), to 85.480 p/th. TTF ICE August 2021 prices were up by 105 euro cents (+3.09%) at the close, to €34.842/MWh. On the far curve, TTF Cal 2022 prices were up by 36 euro cents (+1.46%), closing at €25.154/MWh.

Weak supply and strong Asia JKM prices could continue to lend support to European gas prices today. However, technical resistances (€35.972/MWh on TTF August 2021 and €25.583/MWh on TTF Cal 2022) could contribute to limit gains.