3 standard deviations away

Brent prompt future contract significantly recovered yesterday, to reach 64.7 $/b. Crude prices were boosted by rumours that OPEC members could roll over the current production…

Get more analysis and data with our Premium subscription

Ask for a free trial here

European gas prices extended gains yesterday on the back of ongoing tight fundamentals, as reflected by the weak levels of net storage injections (and stocks). Indeed, Norwegian flows remained weak yesterday, averaging 278 mm cm/day, compared to 275 mm cm/day on Monday (and 323 mm cm/day a week before), due to maintenance works at the Troll field. Russian supply dropped slightly to 325 mm cm/day on average, compared to 331 mm cm/day on Monday. Moreover, the rise in Asia JKM prices (which pulled the European ceiling price up) provided support, particularly to curve prices.

Note that, as expected, Gazprom once again decided not to purchase interruptible monthly capacity via Ukraine at the latest auction run yesterday by Ukraine’s gas grid operator GTSOU.

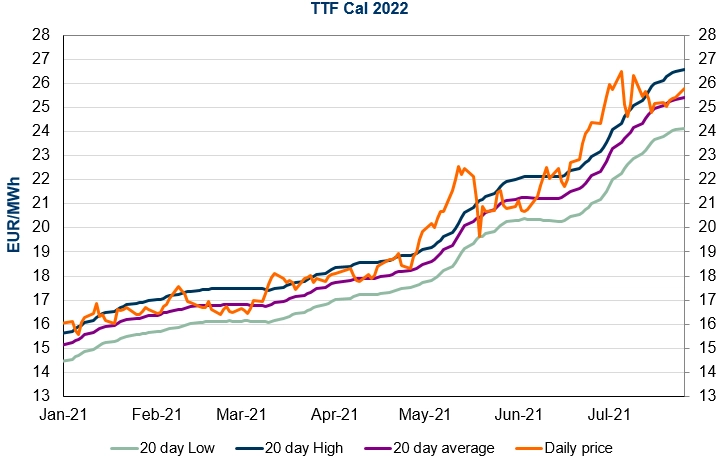

At the close, NBP ICE August 2021 prices increased by 2.800 p/th day-on-day (+3.01%), to 95.790 p/th. TTF ICE August 2021 prices were up by 68 euro cents (+1.83%) at the close, to €37.590/MWh. On the far curve, TTF Cal 2022 prices were up by 23 euro cents (+0.91%), closing at €26.024/MWh.

Tight fundamentals could continue to exert an upward pressure on European gas prices today. However, technical resistances (€37.809/MWh on TTF August 2021 and €26.258/MWh on TTF Cal 2022) could contribute to limit gains.