Curve prices up after a volatile session

NWE spot baseload power prices were up yesterday, to €118.879/MWh on average for today delivery (compared to €112.274/MW for Wednesday), supported by forecasts of lower…

Get more analysis and data with our Premium subscription

Ask for a free trial here

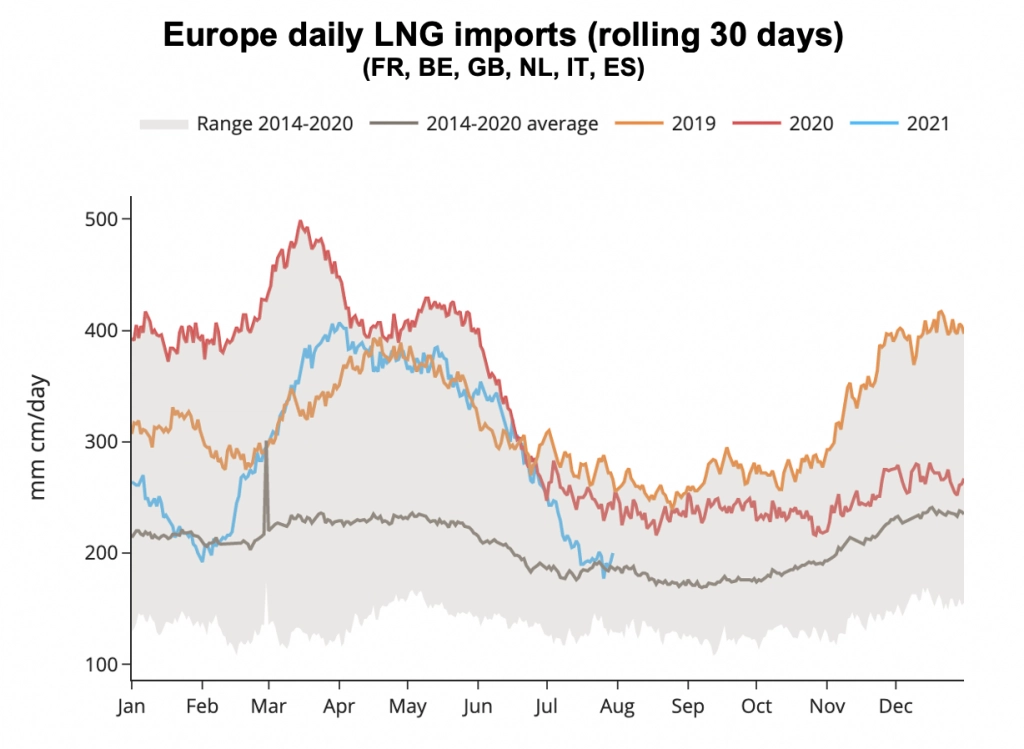

Natural gas prices continued to rise to record highs on Thursday with TTF prices trading above €40/MWh for the first time ever while JKM prices are approaching 8-year seasonal highs and are keeping European LNG supply tight (see below chart). Time spreads also traded in unchartered territories with the TTF Q4 21-Q1 22 spread nearing the €3/MWh mark and the WIN 21-SUM 22 spread settling at €15.60/MWh, highlighting the massive risk premium for the coming winter period. In the US, Tellurian’s Driftwood LNG project made a step closer to FID with the signature of a 3 mmtpa SPA with Shell for 10 years yesterday.

Volatility is likely to remain at elevated levels at European gas hubs today as fundamentals remain supportive but most contracts are trading in overbought territory. Overall, the bullish potential of EU gas prompt prices looks not exhausted regarding the upper bound of the coal-to-gas switching channel (see our TTF month-ahead prices vs key markers chart) and the willingness of Asian LNG buyers to maintain spot prices at high levels in the Pacific Basin to keep attracting cargoes so far.