Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

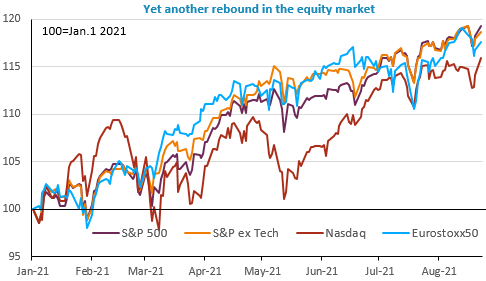

Equity markets and commodity prices rebounded sharply yesterday as the dollar lost ground: the exchange rate against the euro rose to around 1.1750. The bond market is more cautious with a stable US 10-year rate just above 1.25%, before the Jackson Hole symposium at the end of the week.

The fact that China no longer has any cases of local transmission of the virus and the FDA’s full approval of Pfizer’s vaccine in the US has supported optimism (it could help to revive the vaccination campaign). The resilience of Eurozone PMIs around 60 in August is also good news. The fact that services PMIs fell sharply in the UK and the US, but remain high at around 55, may finally reflect a normal moderation in the pace of growth, rather than a shock from the resurgence of Covid cases.

German GDP growth was revised slightly higher in Q2 (+1.6% q/q). US new home sales are expected in the afternoon.

Get more analysis and data with our Premium subscription

Ask for a free trial here