Power prices extended losses tracking the waning gas market

The European power spot prices faded yesterday amid forecasts of milder temperatures and stronger renewable production. Prices eroded 4.38€/MWh to reach 57.24€/MWh on average in…

Get more analysis and data with our Premium subscription

Ask for a free trial here

Broad rebound in equity markets yesterday, but the US 10y remains stuck at 1.2% this morning, after having even touched 1.13%. The market remains cautious but with such low bond yields, investors have no choice but looking at riskier assets to find a descent return on investment. Moreover, the US earnings season has started and not disappointed so far. The peak of growth may be behind us but growth remains solid. The USD kept on strengthening, not really a sign of confidence: the EUR/USD exchange rate is now trading around 1.1760.

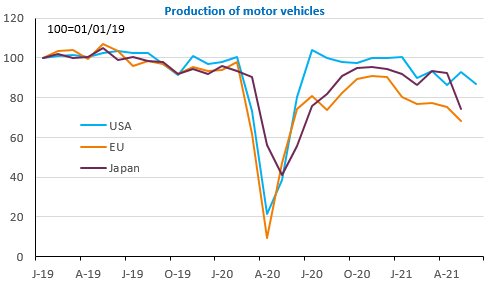

Worries about the spread of the Delta variant have not evaporated suddenly and may continue to trigger profit taking in the coming days. The Biden administration had reassuring words yesterday about the global semiconductor supply shortage that restraints activity in the key auto sector at global level, not only in the US. They are “starting to see signs of relief”. If that is the case, it will probably not last for long, as South-East Asia, where most of chips are produced, is facing a sharp resurgence of Covid cases, with low vaccination rates. For these countries, lockdown remains the only solution.