Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

Crude prices jumped, with Brent October contract reaching 72 $/b, as the Ida hurricane threat became clearer. Ida is expected to reach oil infrastructures by Sunday, passing through the Gulf of Mexico’s main offshore fields and landing in Lake Charles and Baton Rouge, where significant refining capacity is (Exxonmobil, Citigo and Phillips 66 refineries account for 1.2 mb/d of crude capacity).

As Ida strengthened and was expected to make landfall as a category 2 event, most oil producers announced the evacuation of offshore platform workers. There is about 300 kb/d of oil production capacity at risk of a shut-in, given the magnitude of this weather event.

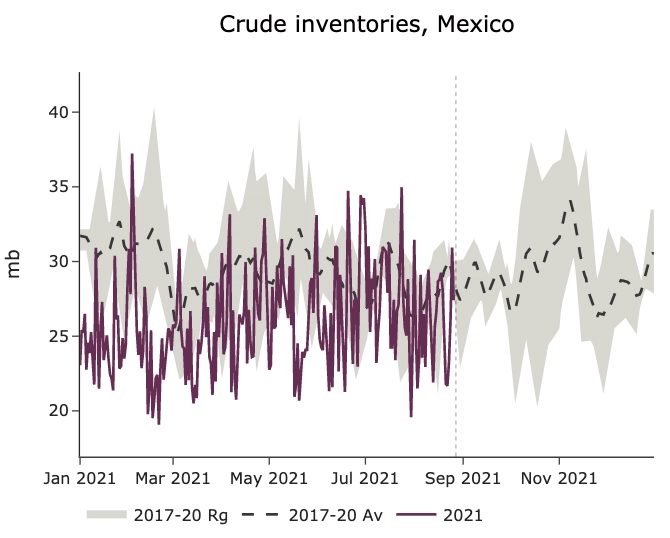

Looking at Mexico’s efforts to restore output after a fire broke at Pemex’s main producing facility – KMZ – internal sources are increasingly doubtful that output will be restored by August the 30th. Pemex’s crude is mainly exported to the US, as its sour crude is fitted for US complex refineries. Mexico’s total crude inventories are at about 30 mb, but there is only 7 mb of commercial stocks available for export purposes, according to kpler’s latest measurements.

We estimated that the impact of the outage until Aug 30th would result in a loss of production of 4 mb. Depleting stocks further would probably force Pemex to lower exports. If Ida’s were to impact crude production more than refineries, US baseload crude supply would be seriously dented for the month to come, forcing the US to run down stocks.

Get more analysis and data with our Premium subscription

Ask for a free trial here