EUAs and power prices posted gain on rising gas prices

The European power spot prices faded further yesterday, weighted by forecasts of rising wind and hydro generation, although the stronger power demand expected today might…

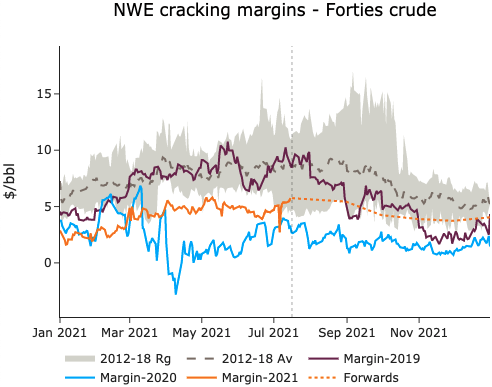

With another decline in crude oil prices, especially at the prompt, and product prices remaining supported, European refiners are back closer to their average profitability levels. Indeed, ICE Brent crude futures declined further, to reach 73.1$/b for September delivery. The time structure also weakened, at 67 cents. Yet, product prices, especially light ends such as naphtha and gasoline, remained supported by European demand and exports. As a result, margins are increasingly within the 5y average range, despite diesel cracks remaining below historical norms.

Get more analysis and data with our Premium subscription

Ask for a free trial here

ARA inventories continue to reflect this uneven scarcity across refined products. Naphtha and gasoline stocks plunged this week by 1.5 mb combined. Following the historic floods in Germany, this decline could persist, as rising Rhine water levels are making it impossible to ship barges of refined products (coming from inland refineries in Germany) through the river. Diesel stocks remained constant last week, while jet fuel stocks remained elevated, despite rising European flight numbers.