OPEC+ members strike a deal

On Sunday, OPEC+ members met for a rapid meeting, delivering a suite of production decisions going forward. The current production agreement between OPEC nations and…

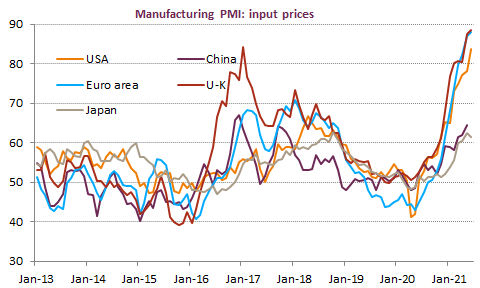

Limited market moves again yesterday, as Fed members continued to send mixed signals on monetary policy. Preliminary PMIs confirmed the strength of activity growth but also raising tensions on production costs. The economic agenda is full today with in addition, a Bank of England meeting and many Fed speakers again. The EUR/USD exchange rate remains rather stable around 1.19.

Get more analysis and data with our Premium subscription

Ask for a free trial here