Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

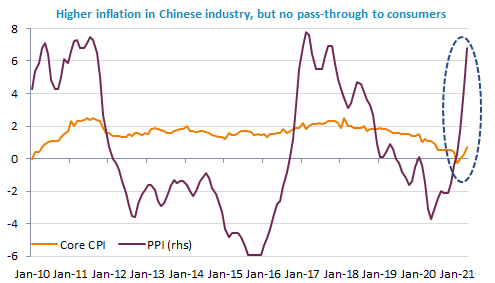

It’s paradoxical but the poor US jobs report has brought inflationary fears back to the forefront of market concerns. The Nasdaq plunged by 2.6% yesterday on worries about the consequences of higher interest rates on expensive stocks’ valuation. Market measures of inflation expectations or surveys all reflect these fears, but the bond market stays calm, persuaded that the Fed will keep on purchasing bonds until temporary tensions disappear. The US 10y remains around or most often below 1.6%. The USD has not regained the lost ground, around 1.2150 vs the euro. Chinese inflation figures released overnight were not particularly worrying, but the key event of the week will be the release of the April US inflation data tomorrow.

Get more analysis and data with our Premium subscription

Ask for a free trial here