Emissions strongly rebounded over the last session of the week

The European power spot prices for today dropped significantly compared to Friday amid a sharp rise of temperatures and wind output offsetting the lower French…

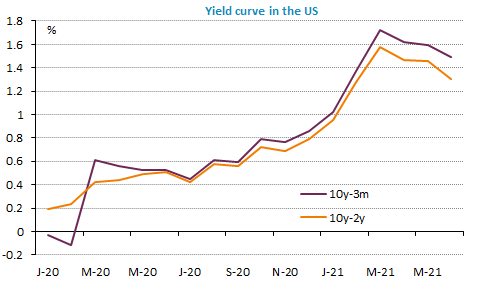

Long-term bond yields have erased most their post Fed-meeting rise yesterday but the rise persists on shorter-term maturities. This reflects expectations that the Fed should tighten its policy sooner than expected and therefore be able to keep inflation under control. The equity market resisted well in this context. US tech stocks even rebounded. The USD kept its gains too and even reinforced them: the EUR/USD exchange rate plunged to 1.19.

Get more analysis and data with our Premium subscription

Ask for a free trial here