Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

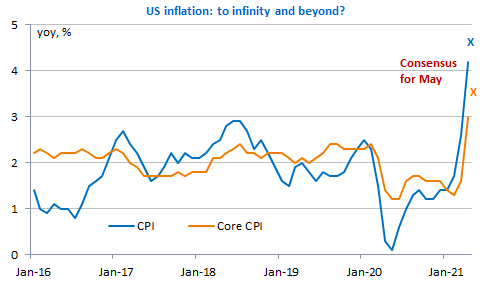

These are the key events of the week: the ECB meeting and the May US inflation report. The ECB is expected to extend its extra bond purchases and US inflation to accelerate further. In front of that, bond yields are falling sharply: the US 10y plunged below 1.5% for the first time since early March. The dominant view seems to be that this reflects confidence in the transitory nature of the surge in inflation, which means central banks will keep very accommodative policies. This reasoning seems flawed and the risks of a rebound in bond market volatility look quite high. The EUR/USD exchange rate is now trading around 1.2165, slightly down on expectations of a dovish ECB’s decision.

Get more analysis and data with our Premium subscription

Ask for a free trial here