Curve prices down on slightly lower clean fuel costs

NWE spot baseload power prices were slightly up yesterday, to €93.285/MWh on average for today delivery (compared to €89.703/MWh /MWh for Wednesday), supported by expectations…

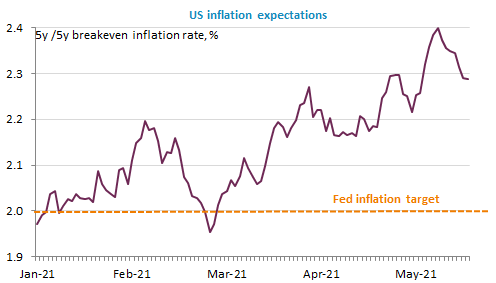

Equity markets rebounded, bond yields edged down and the USD weakened: the impact of the Fed minutes has evaporated or maybe the markets are relieved to see the Fed starting to face up to the inflationary risk as long as the economic recovery is being confirmed. Preliminary PMIs will be released today. The bad Japanese figures should not set the trend. The EUR/USD exchange rate is trading close to its February’s high, near 1.2240.

Get more analysis and data with our Premium subscription

Ask for a free trial here