Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

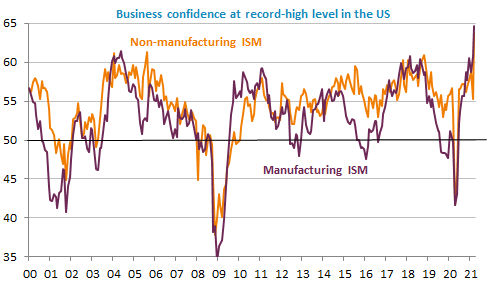

The US stock market reached new record-high levels yesterday after the ISM index in services did the same. Economic indicators released over the last few days have all beaten the most optimistic forecasts, pointing to a very strong rebound. In this context, the stabilization in bond yields is quite surprising: the US 10y bond yield is even slightly down, below 1.7%, which seems to reflect very limited inflation fears. The USD is down due to the rebound in risk appetite and the EUR/USD pair is trading above 1.18 again. This is part of the explanation for a mixed session in Asian equity markets, but there is also the fact that the Chinese central bank has asked the main banks to limit loan distribution for the rest of the year.

Get more analysis and data with our Premium subscription

Ask for a free trial here