Mixed price evolution

European gas prices were mixed yesterday. Russian flows increased slightly, averaging 218 mm cm/day, compared to 213 mm cm/day on Tuesday. By contrast, Norwegian flows…

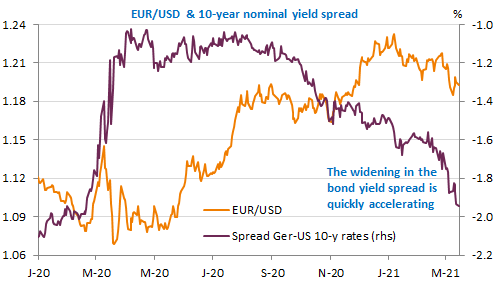

The US Treasury bond yield is now trading above 1.6%, while the ECB has managed to stop the increase in the euro area. In this context, the EUR/USD pair remains under downward pressure but not as much as we could have thought: it is trading around 1.1930 this morning. Chinese economic reports showed activity sharply up yoy due to a huge basis effect. A closer look at the figures shows that industrial activity is robust, consumer spending and investment much less.

Get more analysis and data with our Premium subscription

Ask for a free trial here