Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

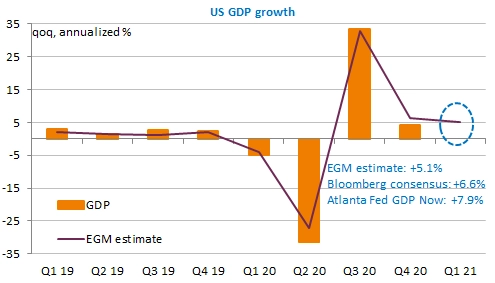

Optimism should prevail on financial markets: the Fed was more confident about activity recovery but committed to let its policy unchanged, as the inflation spike should remain “transitory”. Joe Biden unveiled his new $1.8tn stimulus package focused on social measures and tax fairness. The plan will now be debated at the Congress and will likely be substantially modified, but it marks a good end to the 100 first days of Mr. Biden’s presidency. The economic agenda is full today: inflation and unemployment in Germany, EU Commission survey, money and credit in the euro area and the first estimate of Q1 GDP growth in the US! Risk appetite supports the euro vs the USD: the EUR/USD exchange rate has broken a key resistance and is now trading above 1.21.

Get more analysis and data with our Premium subscription

Ask for a free trial here