Strong clean fuels push European power prices higher

Strong gains in clean fuel costs pushed European power prices higher on the curve on Tuesday. Gazprom’s decision not to book additional transport capacity through…

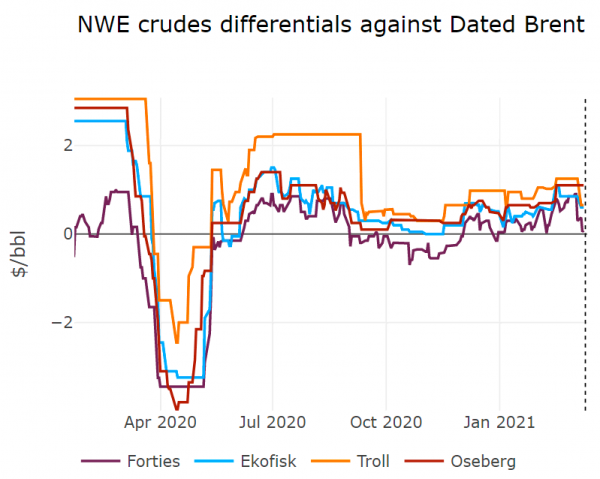

Crude prices remained broadly steady as the EIA weekly snapshot reflected a growing discrepancy between US crude oil and fuel markets with a net build in inventories of 1.3 mb. Similarly to last week, recovering refining runs in Texas was unable to follow the pace of crude production or fuel demand, leading to a 13.8 mb build in crude oil inventories and large draws in gasoline and distillate stocks. Weak Chinese crude demand continues to impact crude markets globally, with evidence of a slowdown in purchases in the West African market.

Get more analysis and data with our Premium subscription

Ask for a free trial here