Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

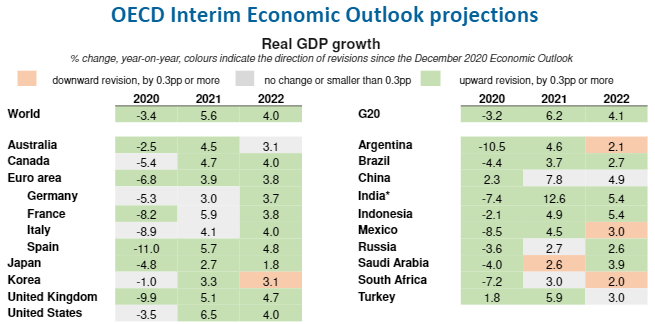

The 3.7% rebound in the Nasdaq yesterday has all the characteristics of the so-called “dead cat bounce”, a brief moment of respite in a bear market. It was linked to some improvement in the bond market for not very obvious reasons, the US 10-y bond yield easing below 1.55%. But inflation fears should quickly reappear. The House of Representatives should vote the $1.9tn stimulus plan today and it is expected to boost US GDP and global growth this year, as the OECD made it clear in its interim economic outlook released yesterday. Thanks to stronger risk appetite, the EUR/USD exchange rate rebounded above 1.19, but failed to confirm its gains.

Get more analysis and data with our Premium subscription

Ask for a free trial here