Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

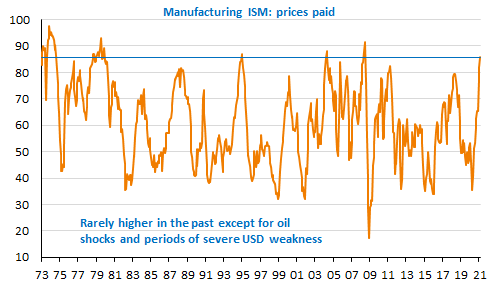

Equity markets rebounded yesterday despite the parallel rise in bond yields, as the manufacturing PMIs and ISM all pointed to robust global activity. But the market sentiment turned down overnight after the top Chinese banking regulator expressed deep concerns about bubbles on overseas financial market and said the domestic property market was driven by “very dangerous behavior”, suggesting monetary policy could be tightened. The February euro area inflation data will be released today. It is expected to show a pause in the rise before strong acceleration in the coming months. The price component of the manufacturing ISM also pointed to exceptional upward price pressures. The USD is strengthening: the EUR/USD exchange rate is nearing 1.20.

Get more analysis and data with our Premium subscription

Ask for a free trial here