Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

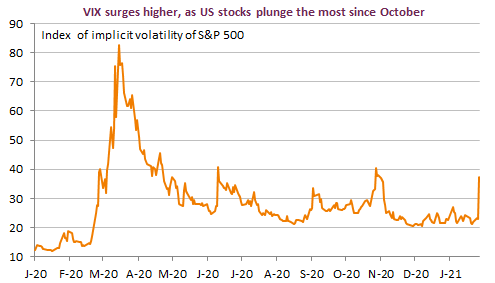

Doubts about the US stimulus package and vaccine shortages are worsened by panic among short-sellers linked to the GameStop mania. The “fear index”, the VIX, surged higher to levels last seen in October precisely, just ahead of the US presidential election. As expected, the Fed reaffirmed its commitment to keep purchasing bonds at the current pace for a long period of time, but the trend has not changed. The USD keeps on gaining ground. The EUR/USD was almost back to its previous low, just above 1.2050 and is still trading below 1.21. Q4 US GDP growth today. Everybody expects a sharp slowdown but still positive figures. This is the breakdown of data that will matter.

Get more analysis and data with our Premium subscription

Ask for a free trial here