Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

The energy crisis hitting Europe from more than a year now has had an historical impact on gas and power markets, with prices reaching unprecedented volatility levels. Such prices shake all market players, put them under severe financial pressure and open a wider eye on how the actual energy market is structured and traded.

The status of the TTF gas hub as the main European gas price benchmark has been challenged in this context, due to a surge in LNG imports and a progressive disappearance of Russian pipeline gas flows.

In this special report, we try to analyze the impact of the crisis on some key metrics often used to take the pulse of market liquidity. You’ll find below some of our main conclusions. The full report is available for Premium users in our EnergyScan platform.

Summary:

1. What is liquidity and why is it important?

As a reminder, the European Union launched the liberalization of gas and power markets at the end of the 1990’s to improve competition on supply to end users, open infrastructure access to third parties and bring transparency on energy prices.

The creation of gas and power hubs was the finality to get a transparent and trustful reference price.

In a traded market or trading hub, liquidity refers to several related factors, such as the number of active participants in the market, the size of bid-offer spreads in the market or the volumes that can be traded without moving the market, etc…

Liquidity itself tends to develop as market players become more confident in the fairness of a market.

And once liquidity increases, it tends to form a virtuous circle. Finally, a liquid hub provides multiple benefits such as a trusted price reference, an easy access to a large supplier and customer base and the possibility of managing volume risk for all market participants at a competitive cost.

2. How are natural gas and power traded?

– OTC: Historically, in Europe, natural gas and power have mostly been traded OTC (Over The Counter), through bilateral agreements usually with adaptable terms (volume profile, delivery points, etc…) but not without holding a credit risk.

– Large exchange platforms (ICE, EEX notably) emerged rapidly with standard products (flat profile, hub delivery), transparent price reporting as well as solutions to cover counterparty risk through collateral and margin calls.

3. How are the trading activities evolving?

A plunge in OTC trading activity

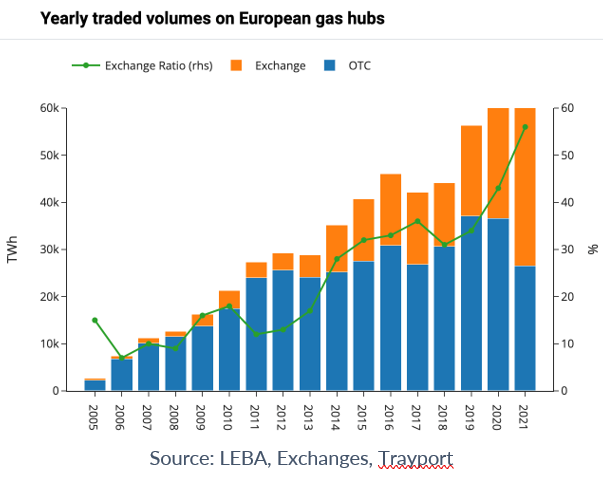

Overall OTC gas traded volumes more than halved in 2022 compared to their peak in 2020.

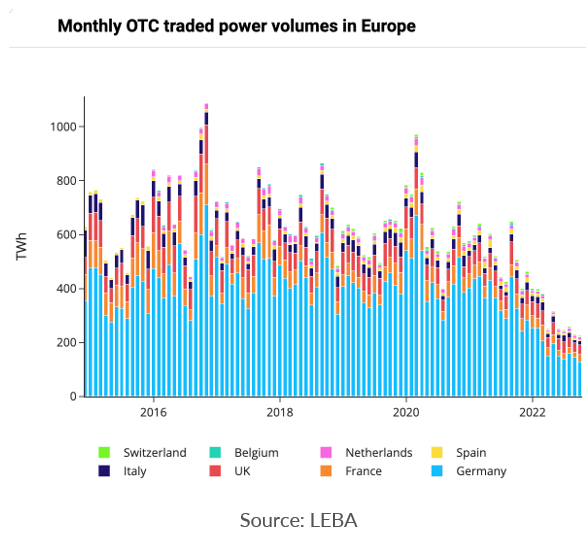

On the power side, the observation is similar with a 48% yoy drop in total power traded volumes across Europe.

Exchange trading resists for gas…

Find detailed figures in the full report

4. TTF front-month and German base CAL+1 contracts remain the main gas and power benchmarks

See more in the report

5. Bid-ask spreads have surged, following intraday volatility

See more in the report

Conclusion: Which outlook for energy market liquidity in Europe?

The period of relentless increase in traded volumes and tightening bid-ask spreads on the main energy benchmarks halted at the end of 2021 with the onset of an historical energy supply crisis in Europe.

Growing counterparty risks accelerated the shift from OTC to exchange trading in gas and power markets with around two thirds of all gas trades and around half of all power trades now performed through exchanges.

But trading activity on exchanges has been affected by the energy crisis as well, with a sharp drop in the size of trading positions held by market players amid extreme volatility levels.

And exchange data also show that the market share of speculative players and their influence on price trends is now limited after a brutal drop of their trading activity in 2022.

Will we come back to record high liquidity levels reached in 2020 and early 2021? Probably not before several years

as…

More insights in the full report

Get more analysis and data with our Premium subscription

Ask for a free trial here