Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

The European power spot prices edged down yesterday amid forecast of slightly stronger renewable production and mixed temperatures. Prices waned by 0.77€/MWh in France, Germany, Belgium and the Netherlands to 51.52€/MWh on average.

Lower temperatures strengthened the French power consumption which rose by 1.93GW from Wednesday to 63.14GW on average. The nuclear generation increased as well to 49.19GW, +1.33GW dod. The German wind production eased by 8.11GW to 15.73GW but is expected to climb to around 17GW today and surged above 30GW over the weekend.

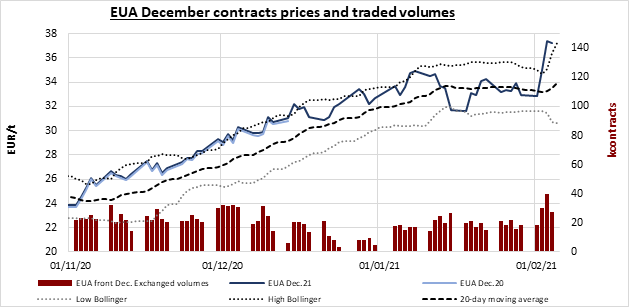

EUAs hit (again) a new all-time at 38.25€/t at the market open on Thursday, but retreated afterward after the morning auction cleared with a massive 0.70€/t discount to the secondary market (although pale compared to the 1.48€/t premium seen on Wednesday), driving prices below 37€/t. Emissions however managed to slightly rebound afterward to eventually settle 37.27€/t with a slight 0.16€/t daily loss. If EUAs remain technically overbought and some correction and profit taking could be expected, the buying interest seems to remain quite strong for now and prices are already rebounding this morning from yesterday’s retreat, likely supported by the bullish gas, oil and financial markets. The current large open interest of call options with a 40€/t strike price could also materialize as the new target for speculators and we could see emissions test this level before sliding back to a level more consistent with the fundamentals.

Lifted by the bullish gas market, the power prices posted hefty gains along the curve yesterday.

Get more analysis and data with our Premium subscription

Ask for a free trial here

We will get back in touch with you soon.

Don’t forget to follow us on twitter!