The energy market in 2025

DOWNLOAD OUR FULL REPORT The energy market in 2025 The energy market in 2025 In 2025, energy markets continued to normalise compared with the 2022…

Get more analysis and data with our Premium subscription

Ask for a free trial here

The European power spot prices jumped near 100€/MWh yesterday as the forecasts of dropping wind output offset the falling clean gas and coal costs. The day-ahead prices hence reached 97.79€/MWh on average, +20.82€/MWh day-on-day.

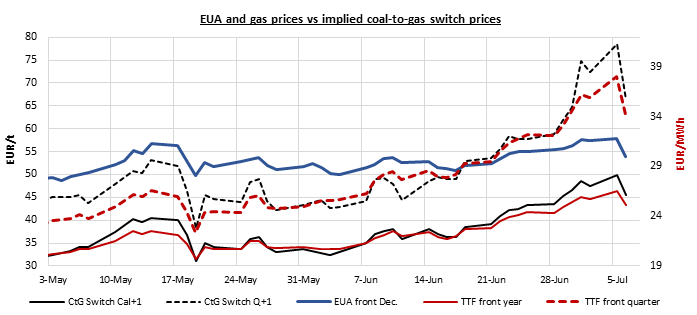

Eroding all the gains from the two previous weeks in the largest sell-off seen since 2006, the EUA prices plunged by 10% to an intraday low of 52.20€/t on Tuesday, tracking the collapsing gas and oil prices and breaking several technical supports with additional pressure from improved French nuclear output prospects and weak economic data.

The power futures prices fell alongside the underlying gas and carbon contracts, with the largest losses observed on the short to mid-term contracts. The massive losses were also attributed to EDF raising its 2021 nuclear output from 330-360TWh to 345-365TWh. The French utility however maintained its 330-360TWh from 2022.