Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

The European power spot prices faded yesterday amid forecasts of milder temperatures and stronger renewable production. Prices reached 57.08€/MWh in Germany, France, Belgium and the Netherlands, -4.02€/MWh day-on-day.

Weakened by the warmer weather, the French power consumption eased further by 1.73GW to 61.46GW on average. The country’s nuclear generation however slightly improved to reach 44.29GW, +0.34GW dod. The German wind generation dropped by 3.45GW from Monday to 6.88GW on average, but should slightly rise to around 9GW today and is forecasted to surge from Friday.

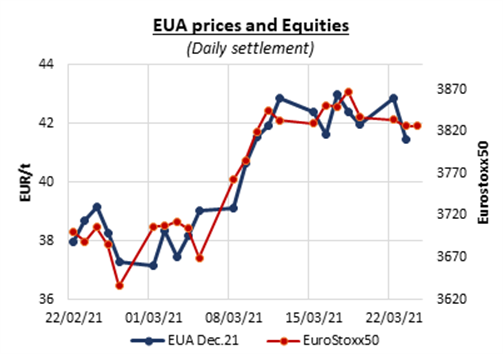

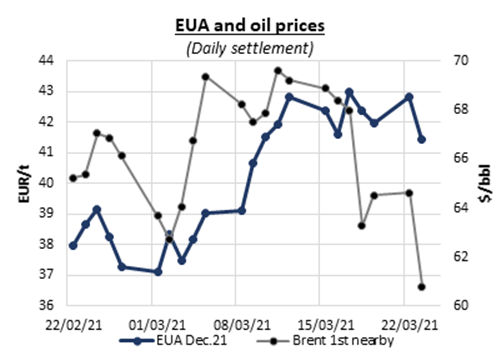

EUAs eroded all the gains from Monday and dropped below the lower limit of their long-term upward trend channel yesterday amid dropping oil prices and pressure on the macro economic environment from the rising concerns about the emerging third wave of virus and extended/tightened lockdown measures across Europe. The EUA Dec.21 contract found some support around 41.60€/t in the afternoon, but a late drop in equities eventually drove them down to settle at 41.43€/t with a 1.41€/t (-3.5%) daily loss.

The falling emissions prices weighed on the power prices which posted losses along the curve, although the stronger underlying gas prices are likely to have limited the downside potential.

Get more analysis and data with our Premium subscription

Ask for a free trial here