Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

The European power spot prices dropped below the clean gas costs yesterday amid forecasts of stronger wind and hydro production and milder temperatures. Prices reached 45.05€/MWh on average ub Germany, France, Belgium and the Netherlands, -4.04€/MWh day-on-day.

The French power consumption eased to 57.78GW on average on Monday, -4.36GW from Friday and -14.93GW week-on-week due to the temperatures rising to nearly 6°C above normal. The nuclear production was also lower at 42.50GW. The wind production faded to 14.19GW on average (-6.70GW from Friday) but should strengthen to around 17GW today and reach nearly 20GW tomorrow before starting to ease once again.

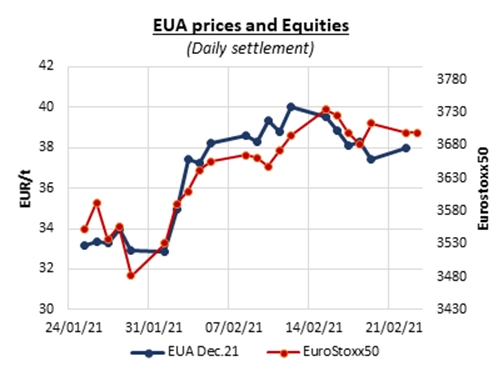

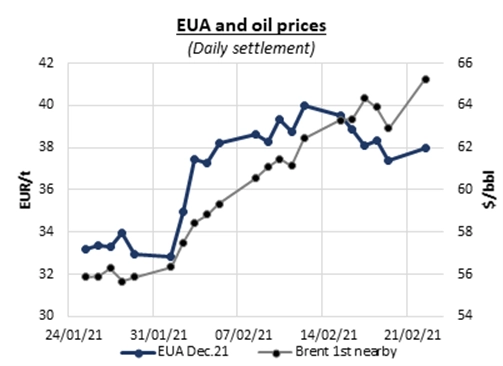

Profit taking, weaker gas prices and an early drop of equities drove the EUAs down on Monday morning to as low as 36.50€/t (-0.90€/t from Friday’s settlement). Carbon prices however sharply rebounded in the afternoon after hitting the lower Bollinger band and eroded all their earlier losses with possible support from the late surge of oil prices and recovering financial markets. The EUA Dec.21 contract eventually closed at 37.96€/t with a 0.56€/t gain from the previous session. The morning’s auction cleared in line with the previous sales with a 0.14€/t discount to the secondary market and an average 1.68 cover ratio.

The power prices posted hefty losses along the curve over the first session of the week, pressured by the dropping gas prices and the early weakness of the carbon market.

Get more analysis and data with our Premium subscription

Ask for a free trial here