Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

The power spot prices edged up in northwestern Europe yesterday, torn between forecasts of weaker renewable production and expectations of improved nuclear availability and lower power demand. The day-ahead prices reached 94.65€/MWh on average in Germany, France, Belgium and the Netherlands, +1.22€/MWh day-on-day.

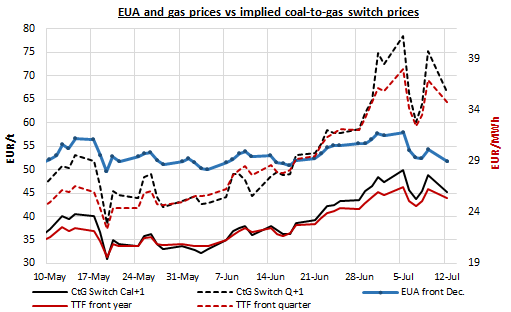

The EUAs dropped by 2.55€/t (-4.7%) in a volatile first session of the week yesterday, driven down by falling gas prices, a weak auction and market participants preparing for the European Commission’s proposals to reform the EU ETS due tomorrow. However, the opinions are diverging on whether the long-awaited publication will support prices or on the contrary will induce a correction in a classic “buy the rumor, sell the fact” move with most of the reforms seen as already priced in by the market. In any case, the tight gas market and the halved EUA auction volumes coming in August are expected to provide support and limit the downside potential of carbon prices.

Meanwhile, the power curve prices tracked the retracement of the underlying gas and carbon markets.

Get more analysis and data with our Premium subscription

Ask for a free trial here